What score does Home Depot pull?

Table of Content

Read on to learn how this card can help pay for your next home renovation, and if this option will really be worth it for you. A balance transfer is a way to move debt from one card to another with the goal of saving money on interest. Generation X borrowers have the highest average mortgage debt, at $259,100. The average mortgage debt is $229,242, per Experian’s most recent State of Credit data.

Many consumers feel that they rely on Credit Karma more than they do on Experian. FICO score, which is an important piece of information for deciding whether or not to borrow money. A high FICO score means you are likely to be approved for a loan, but it does not mean you will be able to borrow money easily. The next best option is the Chase Sapphire Reserve, which also has a 50,000 point sign-up bonus.The easiest card to get approved is the Chase Sapphire Preferred card. This card has a sign-up bonus of 50,000 points which can be applied towards travel and other rewards programs.

What credit score is needed for a Home Depot card?

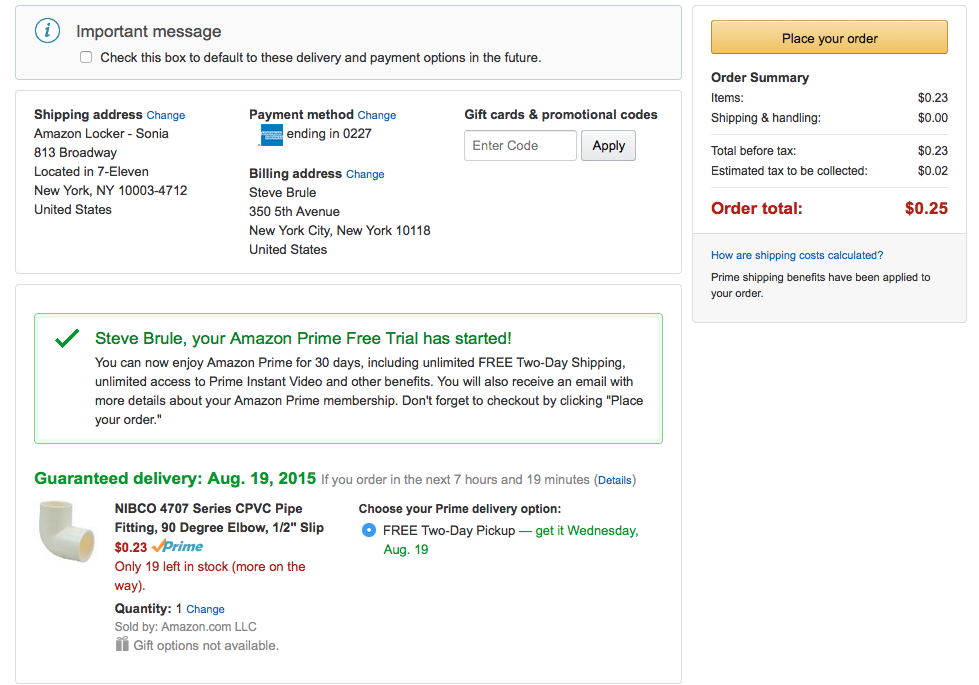

Both Home Depot credit cards are store cards, meaning they can be used only at Home Depot. Their 640+ credit score requirement is consistent with that of other store credit cards. If you're running a business and potentially paying interest attributable to the business income, then those purchases should be separated anyway.

Not only are you earning up to 5% cash back, but you also have the opportunity to double all of the rewards you earn in one year. Although home improvement stores aren’t part of the calendar, you can still earn 5% back on common purchase categories. Cardholders also enjoy rotating exclusive offers, such as 10% off a certain brand for a limited time, or 24-month financing offers during special promotions.

What's the Home Depot Credit Card APR?

Creditworthiness and approval for the Home Depot credit card is determined by all three major credit reporting bureaus. Congratulate a friend on a new home purchase, say thank you for being an amazing employee or happy birthday to the diyer. The regular purchase APR for the Lowes® Advantage Card is 26.99%.

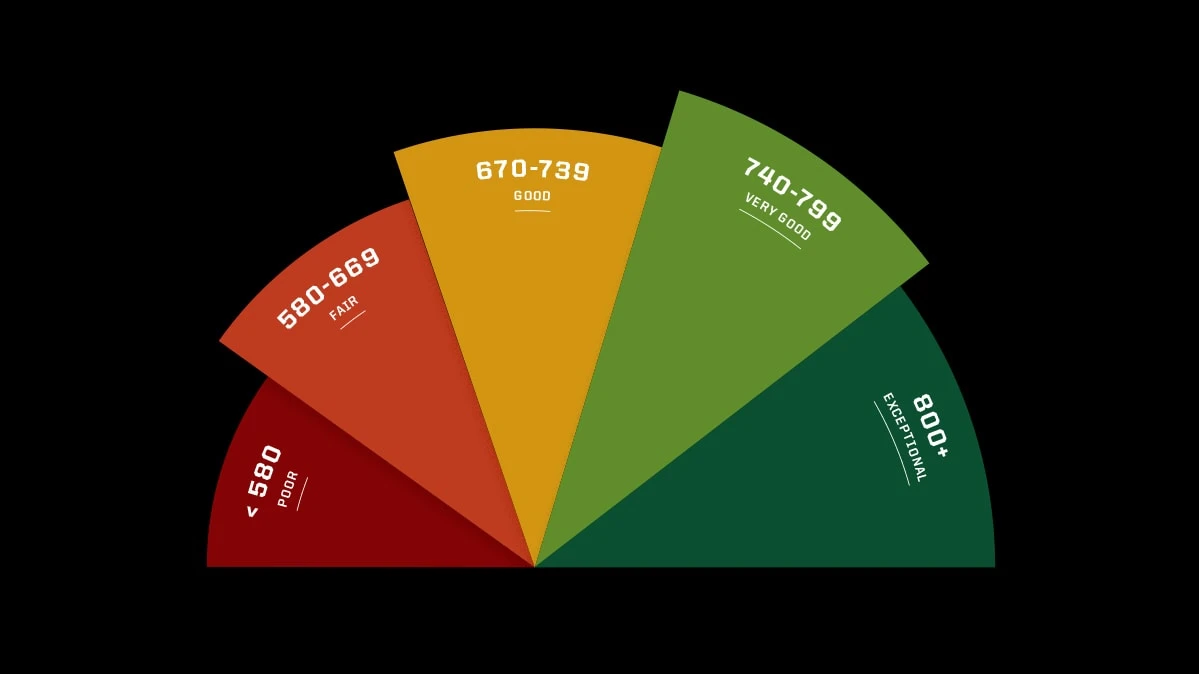

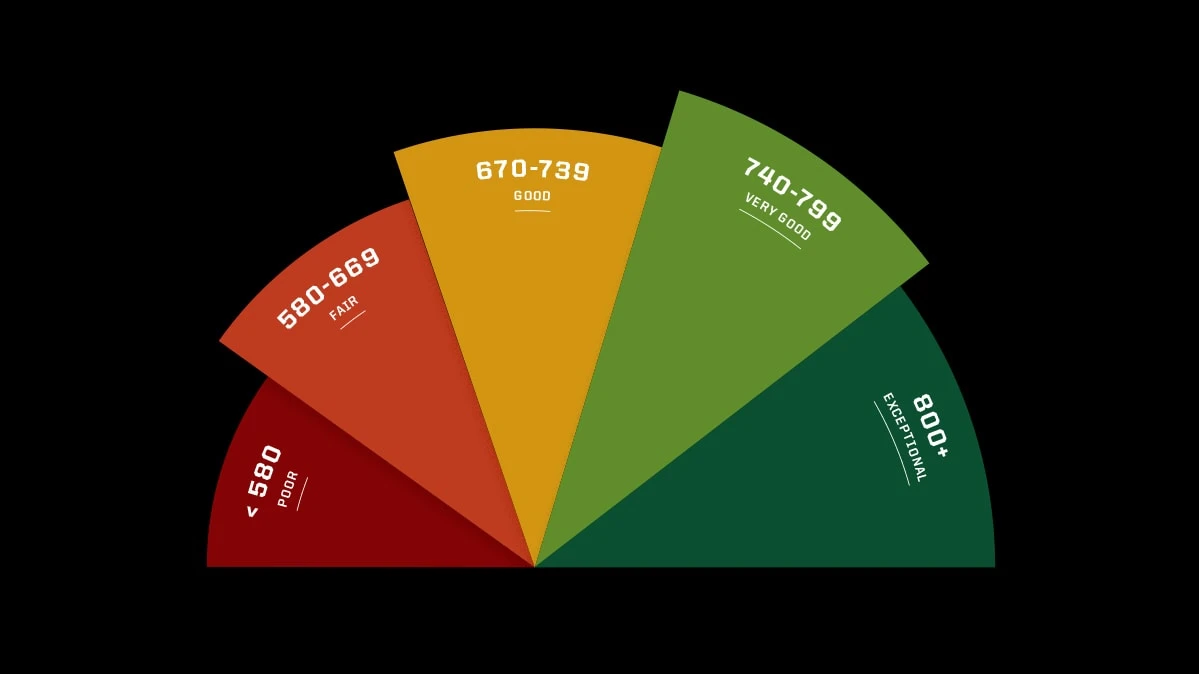

We do not include the universe of companies or financial offers that may be available to you. If you’re thinking about applying for a Home Depot project loan, here are a few other details to consider. Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can. The Walmart Rewards Card specifies that it is looking for applicants with Excellent/Good credit. FICO® considers a fair credit score to be between 580 and 669. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers.

How can I pre-qualify for the Home Depot Credit Card?

Cardholders enjoy a longer return period and exclusive offers. Any score above 670 is considered “good” — but scores of 740 to 799 are very good, and above 800 is exceptional. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. Credit Karma is committed to ensuring digital accessibility for people with disabilities. We are continually improving the user experience for everyone, and applying the relevant accessibility guidelines.

Content is accurate to the best of our knowledge when it’s published. Your path to an improved credit score is only a phone call away. With 007 Credit Agent by your side, you can improve your credit score so that you are eligible for the Home Depot Credit Card and can proceed with the home renovation project as planned. At the low end of the range, buyers with a credit score as low as 500 could be eligible for an FHA loan with a down payment of 10 percent; a score of 580 would require just 3.5 percent down.

After that, you’ll provide some basic information about yourself and your co-applicant, if you have one. And unlike a home equity loan orhome equity line of credit, you won’t have to put up any collateral when you apply. They randomly select Equifax, Experian, or TransUnion to check the applicant's credit.

Improving your credit score can help you qualify for better mortgage rates. Start by getting current on any past due accounts, if applicable, and be sure to make timely payments moving forward. Pay down any credit card debt as much as you can, and if you owe in many different places, consider a debt-consolidation loan that rolls all your debts into one single monthly payment. Other ways to increase your credit score include avoiding applications for new credit and leaving old accounts in good standing open. No prequalification option —If you want to check your potential rate before applying, you can’t apply forprequalificationfor a Home Depot project loan. And Home Depot will pull your credit reports and credit scores at the time of your application.

We will never ever recommend a product or service that we wouldn't use ourselves. Compensation may impact how and where products appear on this site, including the order in which they may appear within listing categories. The information related to Chase Freedom Flex has been collected by Credit Card Insider and has not been reviewed or provided by the issuer or provider of this product. As explained earlier, the financing you get from The Home Depot Consumer Credit Card is deferred interest. While that can help you avoid interest, it’s important to fully understand how deferred interest works. Lowe’s stores also typically have a few more square feet of space than Home Depot stores.

However, some scores may be more difficult to obtain than others. This article covers five credit scores that are commonly considered harder to maintain. It is also one of the most popular cards issued by Home Depot.What is the Home Depot credit card The Home Depot credit card is a popular credit card issued by the Home Depot Inc. The card has a variety of benefits, including free shipping and low interest rates.

Comments

Post a Comment